Introduction

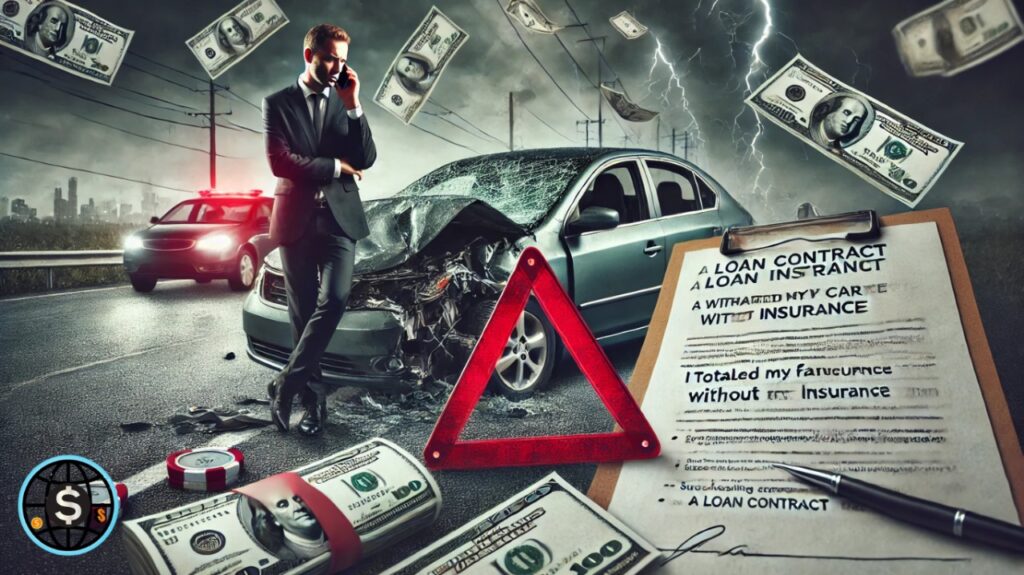

Totaling a car is a stressful event, but the situation becomes even more complex when you don’t have insurance coverage. If you’ve found yourself in this unfortunate position, you’re likely facing a significant financial burden. This article will guide you through the potential consequences and steps to take to mitigate the damage. I Totaled My Financed Car Without Insurance

Understanding the Financial Implications

When you finance a car, you essentially borrow money from a lender to purchase the vehicle. The car itself serves as collateral for the loan. If you total the car without insurance, you’re still responsible for repaying the loan, even though the car is no longer usable.

Potential Consequences

- Outstanding Loan Balance: The most immediate consequence is the outstanding balance on your auto loan. You’ll need to find a way to repay this debt, even without the vehicle as collateral.

- Legal Action: Your lender may take legal action to recover the remaining balance. This could involve lawsuits, wage garnishment, or even property seizure.

- Damaged Credit Score: Defaulting on a loan can severely damage your credit score, making it harder to obtain loans or credit cards in the future.

- Potential Legal Liability: If you were at fault for the accident, you could be held liable for damages to the other vehicle and any injuries sustained by the other driver or passengers.

Steps to Take After a Total Loss

- Contact Your Lender: Immediately inform your lender about the accident and the total loss of the vehicle. Provide them with any relevant documentation, such as a police report or insurance claim.

- Assess Your Financial Situation: Evaluate your financial resources and determine how you can repay the outstanding loan balance. Consider options like selling personal assets, taking on a second job, or seeking financial assistance from family or friends.

- Explore Debt Consolidation Options: If you have other debts in addition to your auto loan, consider consolidating them into a single loan with a lower interest rate. This can help you manage your finances more effectively.

- Seek Legal Advice: Consult with an attorney to understand your legal rights and obligations. They can help you navigate any potential legal proceedings and protect your interests.

- Consider Bankruptcy: In extreme cases, bankruptcy may be an option to discharge your debts, including your auto loan. However, it’s important to consult with a bankruptcy attorney to understand the implications and potential consequences.

Preventing Future Financial Mishaps

To avoid similar situations in the future, it’s crucial to have adequate car insurance coverage. Here are some tips:

- Maintain Comprehensive Insurance: Comprehensive coverage can help protect you from financial loss due to theft, vandalism, or natural disasters.

- Understand Your Policy: Familiarize yourself with your insurance policy, including coverage limits, deductibles, and exclusions.

- Shop Around for the Best Rates: Compare quotes from different insurance providers to find the most affordable coverage that meets your needs.

- Avoid Lapses in Coverage: Ensure that your car insurance is always active to avoid penalties and potential legal issues. I Totaled My Financed Car Without Insurance

Conclusion

Totaling a financed car without insurance can have severe financial consequences. By understanding the potential risks and taking proactive steps to address the situation, you can minimize the damage to your financial well-being. Remember, it’s essential to prioritize responsible financial habits and adequate insurance coverage to protect yourself from unforeseen circumstances.